The Problem

The anonymous nature of Bitcoins is a curse and a blessing. It’s a blessing for illegal goods traders and money launderers but a curse for government authorities trying to stop them.

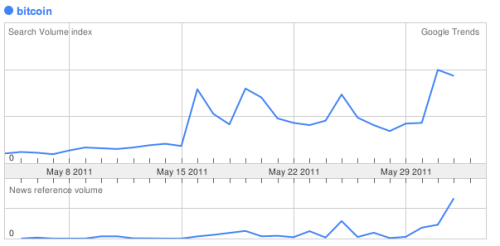

As Bitcoin’s popularity increases, the number of merchants accepting them also increases. This in turn keeps Bitcoin’s valuation high. There are even services to convert Bitcoins into Credit Cards so that they can be used in traditional brick and mortar businesses. This ease of convertibility has introduced a very prevalent problem amongst all anonymous currencies: Money Laundering.

There are sites that already take a small commission to “launder” your coins. Essentially they would send Bitcoin from one address to another (depending on how many times you want it cycled), until it reaches a final destination. Since Bitcoin wallet address are easy to generate, it makes it very easy to send coins from one arbitrary address to another just to make the digital trail a lot more confusing. Since these laundry sites charge only a very small commission, it makes Bitcoins a very lucrative currency to conduct illegal business in. I would like to argue though, that Bitcoins, in fact, help the authorities, and are an aide in tracking down criminals.

To understand my argument, the routine of a criminal needs to be examined: If criminal A wants to transfer money to criminal B for X goods, A would send coins to the laundry and ask it to be cycled a random amount of times before finally delivering to B. Once B receives the Bitcoins, B will cycle it a few more times before sending it to one of the converting sites to convert it into standard currency. But here’s the caveat: All the transactions that were made are recorded openly in the Bitcoin database.

The Analysis

The Bitcoin system is very transparent, yet secure. Everyone contains at least a partial copy of the transaction history. This means that if the FBI wanted to track down these criminals they would only need to find the origin address. After that, tracking the final address would be trivial. They would have to search the Bitcoin database for all the origin address related transactions, and then trace it down until the final receiving address. The Bitcoin laundering only delayed this process. Now that there is a final address, the FBI needs to tie the address to a name. If the final address is tied to a well known converter, it would be easy to catch criminal B.

There are a few issues here though. The converter could be an anonymous user on the Tor Network. This would mean that they can’t be tracked with their IP, which makes tracing much harder. There is also a chance that the Bitcoins could have been converted by an average Joe who sent the criminal a gift certificate for a certain number of Bitcoins, which also makes tracing harder.

Comparison to the US Dollar

These problems make it a lot more difficult to solve the money laundering problem, but its not so bad when compared to physical US Dollars. When US Dollars change hands, there is no way to track how many times in changed hands. There is no history on each bill. In fact, I would argue, that its much safer to launder Dollars because it cannot be traced back to a single person, unless the initial currency was purposely planted and marked. It’s harder to launder Dollars because they are physical items and require a physical location to store them, but that is rarely a concern for criminals. This is evident by the tons of drugs and money criminals store in their homes.

Money Laundering is a serious problem that needs to be tackled, but Bitcoin is not alone in being a victim of this misuse. For every physical, anonymous currency this is a problem. It’s just that with Bitcoins, money laundering has moved to a new domain – the internet. To continue hindering launderers, the relevant authorities need to keep up with current trends, and today Bitcoins seems to be the trend.